October 9, 2018

The Changing Landscape of International Trade

by Duane Jones, PACCAR Trade Programs Manager

What are all the trade actions taken by the Trump administration and our trading partners, and how will they impact the heavy-duty truck industry?

I’ll answer those questions, but first, a quick history lesson on tariffs.

Tariffs, which are taxes on imported goods, were the main source of revenue for the U.S. government for the first 150 years after America was founded in 1776. High tariffs were also used by various administrations during that time to protect American industry from lower priced imports.

In 1914 the Federal Income Tax was implemented, and tariffs were no longer the primary revenue source for the U.S. government. Foreign trade policies eventually focused more on reciprocal and low tariffs, opening the door to more free and open international trade. The world markets continued to develop until the General Agreement on Tariffs and Trade (GATT) was implemented in 1947, and eventually the Word Trade Organization (WTO) in 1995.

So, while it’s been several decades since tariffs were used as a protectionary measure, it’s not a new tactic. There was controversy over protectionary tariffs in early America, and the controversy remains if tariffs are an effective weapon in the current world economy.

Now that the history lesson is over, let’s look at how all the recent tariff actions impact the heavy-duty truck industry.

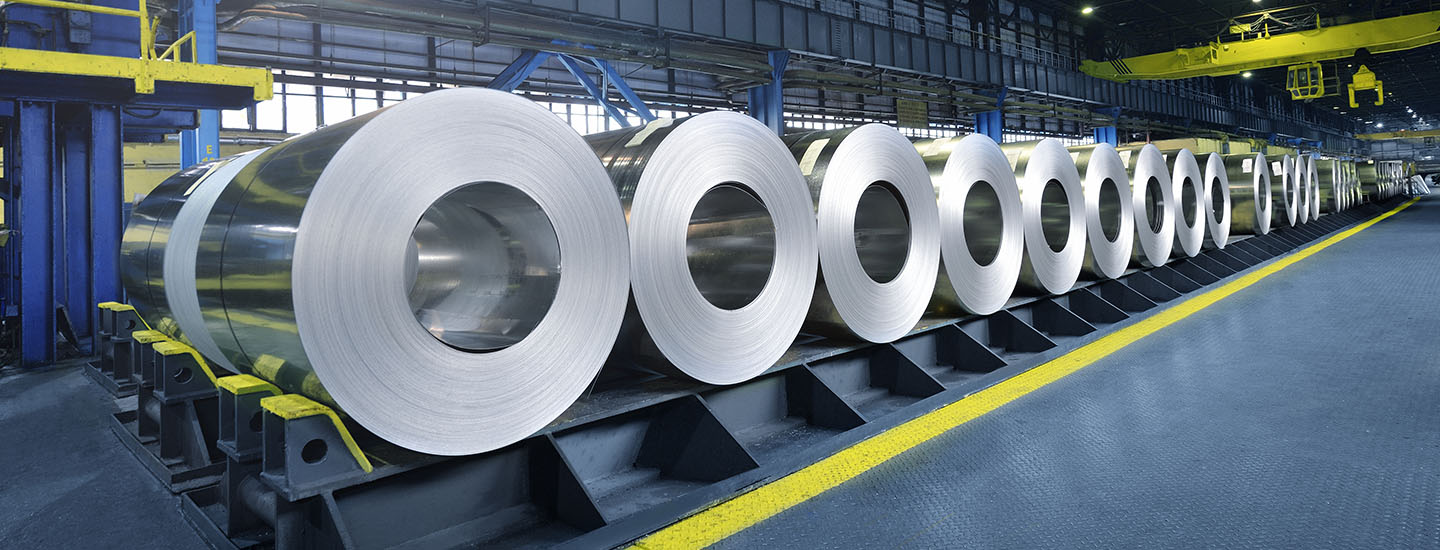

Section 232 Tariffs on Steel and Aluminum:

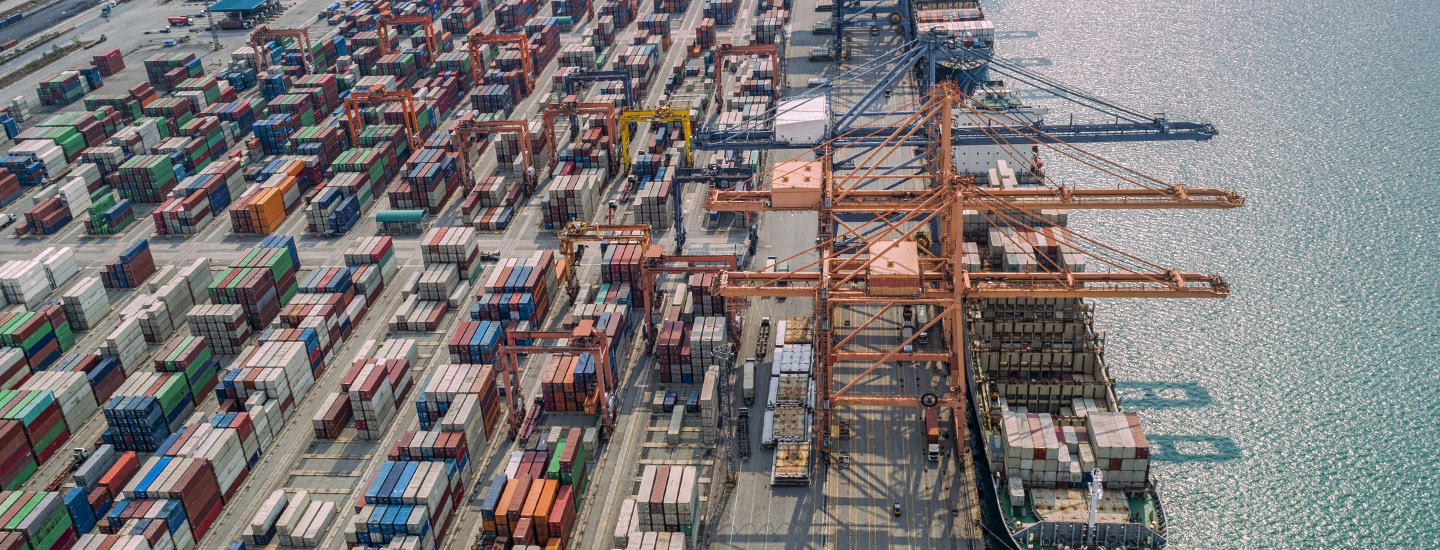

Section 232 of the Trade Expansion Act of 1962 authorizes the President to adjust the imports of goods from other countries through tariffs or other means, if the quantity or circumstances surrounding those imports threaten national security. On March 23, 2018 (June 1 for Canada, Mexico and the EU) tariffs were implemented on steel (25%) and aluminum (10%) imports. Only a handful of countries were exempted from the tariffs, but they are required to adhere to quotas.

The market prices of steel and aluminum have increased over the past several months, which may be attributed to the Section 232 tariffs. Obviously, a lot of steel and aluminum are used to make trucks, so the most likely outcome is that trucks will become more expensive.

How long will the steel and aluminum tariffs stay in place? It’s anybody’s guess, but smart business practices tell us we should plan for them being around for the long term.

Section 301 Tariffs on China:

Section 301 of the Trade Act of 1974 authorizes the President to act against any foreign government that violates an international trade agreement or employs unreasonable or discriminatory trade actions that burdens or restricts U.S. commerce.

On July 6, 2018 the U.S. implemented a 25% tariff on 818 commodities imported from China. China initiated retaliatory tariffs, which prompted the U.S. to implement tariffs on another list of commodities imported from China, and so on. Here’s where we stand.

|

|

Implementation Date |

# of Commodities |

Import Value |

Tariff Rate |

|

List 1 |

7/6/2018 |

818 |

$34 billion |

25% |

|

List 2 |

8/23/2018 |

279 |

$16 billion |

25% |

|

List 3* |

9/24/2018 |

5,745 |

$200 billion |

10% |

*The tariff rate for List 3 will be increased to 25% on 1/1/2019.

Like many other companies, PACCAR sources some of the parts for our trucks from Chinese suppliers. As tariffs are implemented on more and more Chinese goods, the cost of those parts will likely increase, potentially increasing the cost of trucks. But as we’ve just seen in Apple’s case, there is room for exemption from tariffs if they significantly impact US businesses.

NAFTA 2.0

The North American Free Trade Agreement (NAFTA), implemented in 1994, provides tariff free treatment of goods shipped between the U.S., Canada and Mexico. PACCAR saves millions of dollars in tariffs every year by meeting the NAFTA requirements, and our supply chains have been built around ensuring we continue to meet those requirements.

NAFTA has been in the process of being renegotiated for over a year, and on 9/30/2018 negotiators agreed to replace NAFTA with the U.S.-Mexico-Canada Agreement (USMCA). The new heavy truck rules have three main components:

- The percentage of truck materials required to be made in North America will increase from 60% to 70%,

- 70% of the steel and aluminum used to make a truck must be purchased from North American sources, and

- Labor rates of at least US$16 per hour must be paid in the production of a truck, broken into three categories at different percentages.

The new agreement still must be ratified by each government before it is enacted. If approved, the USMCA is slated to start January 1, 2020.

What’s Next?:

A Section 232 investigation is currently underway regarding how automotive imports could affect our national security. President Trump also recently announced that the U.S. will impose tariffs on the remainder of Chinese imports, approximately $267 billion, if China continues to take retaliatory action.

It is unknown if more protectionary tariffs will be announced or implemented, or if the USMCA will get approved by congress. In this tumultuous international trade environment, it’s important that we keep cool heads. PACCAR is well positioned to ride out the storm and will continue to work to make sure our customers are taken care of.